Current Cryptocurrency Market Trends

The cryptocurrency market is experiencing significant evolution, with several prominent trends shaping its landscape. One of the most notable trends is the rise of decentralized finance (DeFi), which allows users to engage in financial transactions without traditional intermediaries. DeFi has garnered immense popularity due to its potential to provide inclusivity, enhancing access to financial services globally. Through various protocols, individuals are now able to lend, borrow, and earn interest on their digital assets, fundamentally altering the way finance operates.

Another notable trend is the growing interest in non-fungible tokens (NFTs). NFTs have revolutionized the concept of ownership in the digital realm, turning virtual assets into unique collectibles that can be bought and sold. These tokens have found applications in art, music, gaming, and other sectors, making them a focal point of investment and speculation. The surge in popularity of NFTs highlights how blockchain technology is enabling new forms of creativity and commerce.

Furthermore, the increasing adoption of cryptocurrencies by mainstream financial institutions marks a pivotal shift in perception. Major companies and banks are now integrating cryptocurrency services into their offerings, signaling a growing acceptance of digital currencies. This trend fosters confidence in cryptocurrencies as legitimate investments, further driving interest from both retail and institutional investors.

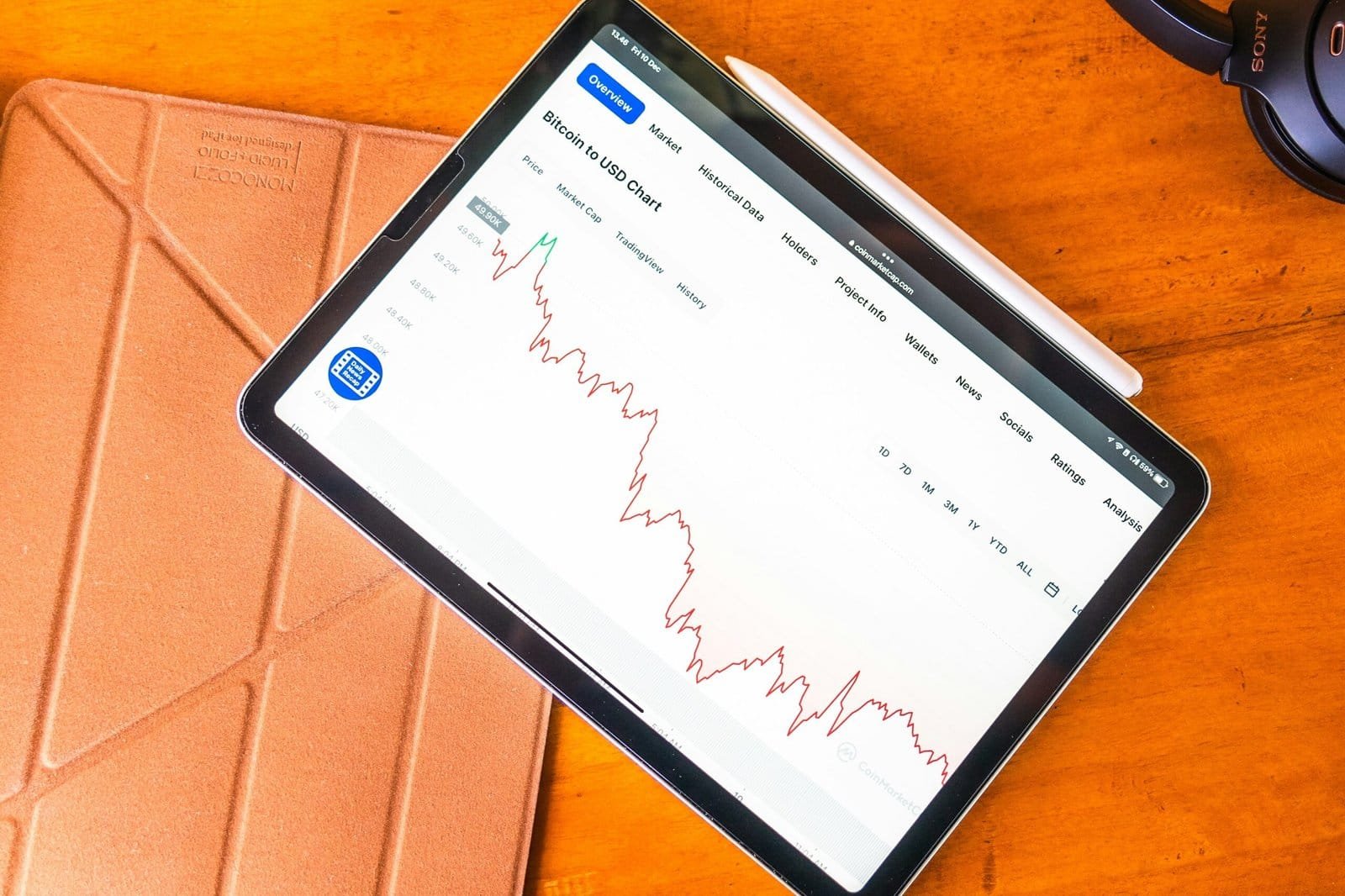

However, these trends have not come without their challenges. Regulatory developments are affecting the cryptocurrency landscape with greater scrutiny from governments worldwide. Compliance requirements and potential restrictions can create uncertainty in the market, affecting traders and investors alike. Additionally, market volatility remains a constant factor, influencing investment strategies and the overall sentiment within the cryptocurrency ecosystem. As these diverse trends continue to unfold, they will shape the future of cryptocurrency and its role in the global economy.

Emerging Altcoins and Their Potential

The cryptocurrency landscape is witnessing a remarkable expansion beyond the established giants, Bitcoin and Ethereum. Emerging altcoins are rapidly gaining traction, attracting both investor interest and community support. These altcoins are characterized by unique features and innovative use cases that set them apart in a crowded market. As the ecosystem evolves, several of these coins showcase potential for significant future growth.

One notable trend within the altcoin market is the emergence of layer-2 scaling solutions. Projects like Polygon (MATIC) aim to enhance transaction speed and reduce costs on the Ethereum network, addressing scalability issues that have previously hindered adoption. By facilitating faster transactions while maintaining robust security, layer-2 solutions present a compelling case for long-term investment. Additionally, they pave the way for broader application of decentralized finance (DeFi) and non-fungible tokens (NFTs), further solidifying the relevance of these evolving ecosystems.

Another prominent trend is the rise of eco-friendly cryptocurrencies that prioritize sustainability. Projects such as Cardano (ADA) and Algorand (ALGO) utilize proof-of-stake mechanisms to minimize energy consumption compared to the traditional proof-of-work approach. As environmental consciousness grows among investors and regulators, these eco-aware currencies may gain a competitive edge. Their commitment to sustainability not only appeals to ethically-minded investors but also aligns with global efforts aimed at reducing the carbon footprint of blockchain technology.

When evaluating these emerging altcoins, investors should consider various metrics, including market capitalization, trading volume, and the project’s community engagement. By analyzing these indicators alongside the unique features and use cases of each altcoin, informed investment decisions can be made. Ultimately, the opportunity for growth among these emerging altcoins is substantial, as they challenge the dominance of established cryptocurrencies and diversify the market landscape.

Technological Advancements Influencing Cryptocurrency

The landscape of cryptocurrency is continuously evolving, predominantly driven by various technological advancements that are reshaping the industry. One of the most significant innovations is blockchain technology itself, which provides a foundational framework for the majority of cryptocurrencies. Blockchain functions as a decentralized ledger that ensures transparency and security by recording transactions across numerous computers, making it resistant to tampering. This has become a cornerstone for various cryptocurrencies as it fosters trust among users and increases the efficiency of transactions.

Smart contracts are another technological breakthrough contributing to the efficiency of the cryptocurrency space. These self-executing contracts with the terms of the agreement directly written into code eliminate the need for intermediaries, thereby reducing transaction time and costs. With their automated nature, smart contracts can facilitate complex transactions seamlessly, which has led to the rise of decentralized finance (DeFi) applications that operate on blockchain networks. The incorporation of smart contracts not only enhances security but also broadens the spectrum of use cases for cryptocurrencies, enabling innovative solutions across various industries.

Furthermore, security enhancements have become paramount in the cryptocurrency domain as the number of users and investments increases. Improved cryptographic techniques and consensus algorithms are being developed to bolster security protocols, mitigating risks associated with hacking and fraud. Additionally, the surge in interest surrounding interoperability between different blockchains signposts an important trend. Interoperable systems allow for the communication and exchange of data across various blockchain networks, leading to a more cohesive digital asset ecosystem. This innovation connects diverse projects and enhances user experience, making it easier for investors and consumers to engage in the rapidly growing world of cryptocurrencies.

Predictions for the Future of Cryptocurrency

The future of cryptocurrency remains a subject of intense speculation and analysis among industry experts and investors alike. As digital assets evolve, there are several key factors that are poised to influence their trajectory over the coming years. Regulatory changes, in particular, stand out as pivotal elements that could either bolster or hinder cryptocurrency’s growth. Countries worldwide are beginning to establish more defined frameworks for managing and regulating cryptocurrencies. This increased clarity may foster greater institutional investment, although it could also present challenges as governments seek to impose restrictions aimed at consumer protection and market stability.

Another significant factor is mainstream adoption. Cryptocurrencies are starting to gain traction beyond niche markets, with businesses and individuals increasingly using them for transactions, investments, and as a store of value. As technological advancements lead to improved wallet security and transaction efficiency, it is likely that more users will embrace cryptocurrencies. Concurrently, the integration of cryptocurrencies into existing financial services could bridge the gap between traditional and digital finance, promoting accessibility and familiarity.

The impact of macroeconomic conditions also cannot be overlooked. Economic volatility often drives interest in alternative assets like cryptocurrencies, with investors turning to digital assets as a hedge against inflation or currency devaluation. Consequently, the rise of central bank digital currencies (CBDCs) might reshape the landscape by providing a government-backed alternative to traditional cryptocurrencies.

As we look ahead, potential scenarios for the cryptocurrency market include continued growth driven by technological integration, coupled with regulatory evolution. Industry consensus suggests that while challenges may arise, particularly concerning regulation and market fluctuations, opportunities for growth and innovation remain robust. Understanding these dynamics will be crucial for investors aiming to navigate the future of the cryptocurrency ecosystem effectively.