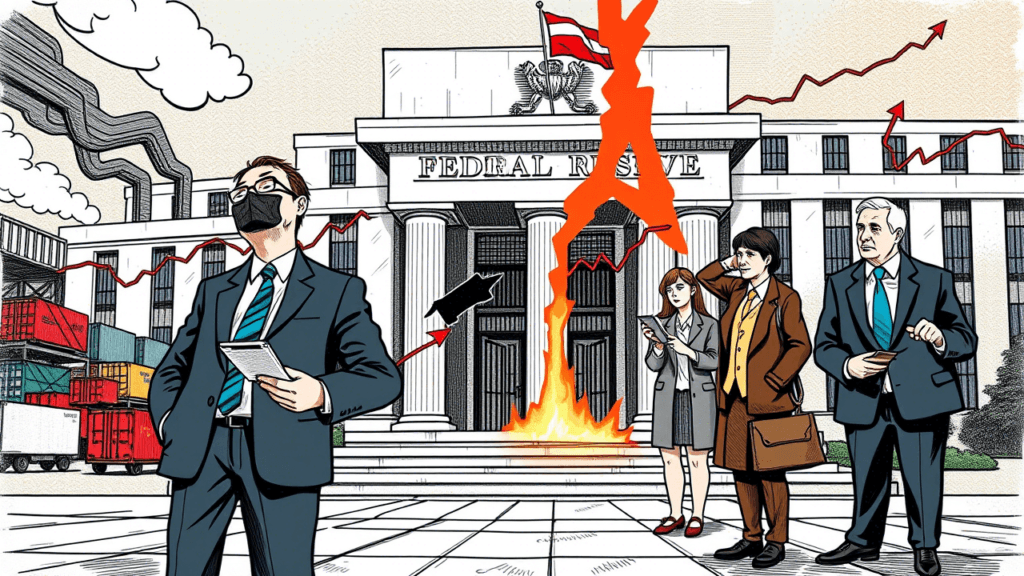

The U.S. Federal Reserve now faces one of its most challenging economic crossroads. With the sudden announcement of sweeping tariffs by President Donald Trump, the delicate balance between controlling inflation and sustaining economic growth has been disrupted. The newly imposed tariffs have sent shockwaves through financial markets, raising concerns about a potential recession and reviving fears of stagflation—a term reminiscent of the 1970s economic turmoil.

Trump’s Tariff Shock: A Global Economic Reset

The administration’s tariff plan, outlined in a dramatic White House announcement, introduced significant import levies on major trading partners:

- European Union: 10%

- Canada and Mexico: 25%

- Vietnam: 46%

- China: Potentially exceeding 50%

These tariffs represent a massive departure from the previous administration’s approach, where the average import tax stood at 2.5%. According to Citi economists, the average import duty may now reach 27%, altering the entire structure of global trade. This sudden change has raised alarm bells across the economic and financial sectors.

Impact on Inflation and Consumer Prices

One of the immediate effects of the tariff increase is its impact on inflation. Higher tariffs directly raise the cost of imported goods, forcing businesses to either absorb the additional expenses or pass them on to consumers. As a result:

- Consumer goods prices are expected to rise significantly, particularly in sectors heavily reliant on imports.

- Manufacturers and retailers face increased production costs, affecting profit margins and pricing strategies.

- The risk of inflation surges grows, complicating the Fed’s approach to monetary policy.

Fed Governor Adriana Kugler acknowledged these concerns, stating that while the U.S. is not currently in a stagflationary environment, there are signs of inflationary pressure building up.

The Federal Reserve’s Dilemma: Inflation vs. Growth

For the past two years, the Federal Reserve has aggressively tackled inflation through interest rate hikes while maintaining a strong labor market. However, the new tariffs introduce conflicting economic signals:

- If the Fed raises interest rates further to combat inflation, it risks slowing the economy even more.

- If it cuts rates to counteract slowing growth, it could fuel inflation, worsening the situation.

Economists warn that the economic uncertainty created by these tariffs is forcing the Fed into a more reactive stance. With Fed Chair Jerome Powell set to speak soon, analysts anticipate a more cautious tone regarding future monetary policy decisions.

Market Reactions: Stock Volatility and Bond Yields

The financial markets responded swiftly to Trump’s announcement:

- U.S. Treasury bond yields declined as investors sought safe-haven assets.

- Stock markets dropped sharply, reflecting uncertainty in corporate earnings and investment outlook.

- Global trade partners began assessing potential retaliatory measures, increasing geopolitical tensions.

Fed officials, including Lisa Cook and Philip Jefferson, are set to deliver remarks, likely shedding more light on how the central bank plans to navigate this economic upheaval.

Stagflation Fears: A Repeat of the 1970s?

One of the biggest concerns among economists is that the U.S. might slip into stagflation—a period characterized by high inflation and economic stagnation. Historically, stagflation has been one of the most difficult economic conditions to address, as traditional monetary tools either exacerbate inflation or deepen the slowdown.

Krishna Guha, Vice Chair at Evercore ISI, highlighted the dilemma, noting that the Fed may be forced to choose between:

- Holding rates steady to keep inflation expectations anchored.

- Implementing multiple rate cuts if the economy enters a sharp downturn.

At this point, the probability of zero rate cuts, two or three, or even five-plus cuts remains highly uncertain, leaving markets in disarray.

U.S. Growth Outlook: Are We Heading for a Recession?

The growth outlook for the U.S. economy has taken a significant hit following the tariff announcement. TS Lombard economist Steven Blitz warned that if these tariffs remain in place, they could be a tipping point toward a recession.

The primary reasons include:

- Higher production costs, reducing corporate investments.

- Weaker consumer spending, as goods become more expensive.

- Disrupted global supply chains, affecting key industries such as technology and automotive manufacturing.

Many analysts now believe that 2025 GDP forecasts may need to be revised downward, with a growing probability of negative growth in the latter half of the year.

Global Trade Tensions and Potential Retaliation

The U.S. is not the only economy affected by these tariffs. Trading partners, particularly China, Canada, and the European Union, are already considering countermeasures. Potential retaliatory actions could include:

- Increased tariffs on U.S. exports, hurting American businesses.

- Restrictions on American technology companies operating in foreign markets.

- Currency devaluations to counteract the cost impact.

As the global trade war escalates, economic analysts fear a repeat of the 1930s Smoot-Hawley Tariff Act, which significantly worsened the Great Depression.

Conclusion: The Fed’s Next Move Will Define the Economy’s Future

With Trump’s tariff policies now in motion, the Federal Reserve faces one of its toughest decisions in recent history. The challenge lies in striking a balance between controlling inflation and preventing an economic slowdown. Whether through monetary tightening, rate cuts, or a more nuanced approach, the coming months will be critical in determining the direction of the U.S. economy.

As financial markets remain volatile and global trade relationships shift, all eyes are on the Federal Reserve and its ability to navigate these turbulent waters.